Piraeus Income 2026 European Bond Fund

Key Facts

|

Currency

|

€

|

| Inception Date |

19/1/2024

|

| Benchmark |

|

| Assets Under Management |

€205,825,276.59

|

|

Net Asset Value

|

€10.2503

|

|

ISIN

|

GRF000474004

|

|

Management Fee

|

0.60%

|

| Management Company |

Piraeus Asset Management MFMC

|

|

Depositary

|

Piraeus Bank

|

|

Reference Date

|

24/4/2025

|

Reference Date

This is a marketing communication. Please refer to the Forms of the Fund before making any final investment decisions.

28.02.2025

Investment Objective

The investment objective of the Fund is to increase the value of its investments, providing mainly return of income as well as capital growth, by investing its assets mainly in a diversified portfolio of debt securities in euros. Investment in equity shares cannot exceed 10% of the Fund's net assets. The Fund may also hold liquid assets.

The fund will be fully liquidated by 27.02.2026. Therefore, during the beginning of the Fund's investments, the average portfolio duration will approach 24 months.

The Mutual Fund is suitable for investors with a 24 months investment horizon, who seek to maintain their investment throughout the duration of the Fund and seek income and capital gains through investments in a diversified portfolio of mainly debt securities in euro.

The period of accumulation of the assets of the Fund will end on 29/02/2024. From this date onwards, the Fund will not accept new subscriptions

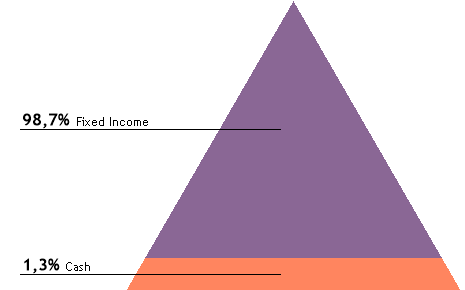

Asset Allocation

Synthetic Risk Indicator

Investment Amount Evolution €10.000

1 year

Investment Amount Evolution €10.000

5 years

Investment Amount Evolution €10.000